Credit Score Report

Credit information is gathered by credit reporting agencies, sometimes called credit bureaus. There are two major credit reporting agencies in Canada: Equifax Canada Co., and TransUnion of Canada. Governed by provincial and federal laws, credit reporting agencies store and maintain credit information about individual Canadian consumers for use by members of the credit reporting agency. Members include banks, finance companies, auto leasing companies, credit card companies and retailers.

Credit grantors update individual credit reports regularly by providing information to credit reporting agencies about their customers’ credit and payment activities. This ensures that credit reports remain up-to-date and as complete as possible. Other sources of the information contained in your credit report can include public records from courthouses across the country and collection agencies.

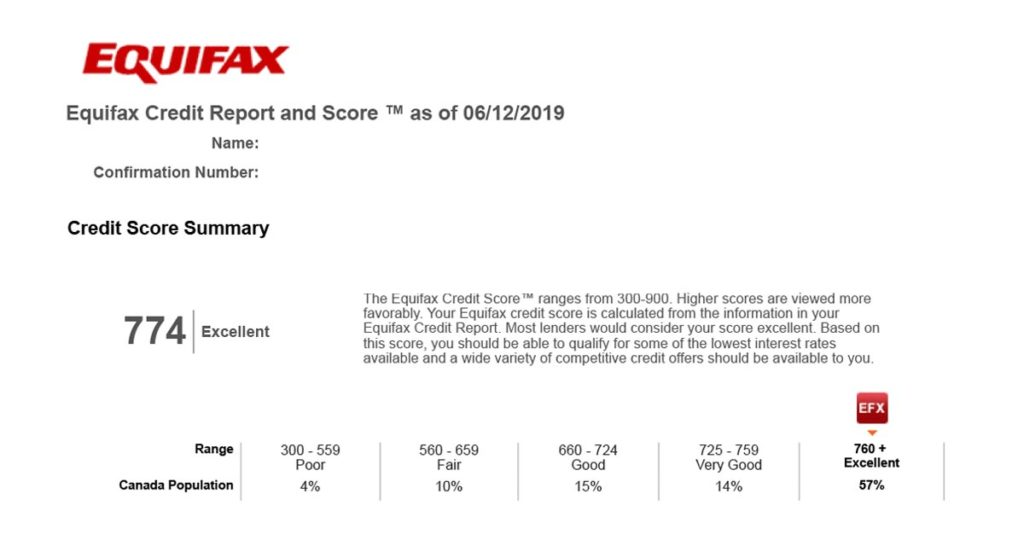

A credit score is a statistical formula that translates personal information from your credit report and other sources into a three-digit score. For example, when you fill out a loan application, pieces of information from the application along with information from your credit report will be used to compute a score that indicates to the lender the statistical probability that you will become delinquent on the loan.

It is important to understand that a credit score is only one criterion that a lender will use in making decisions. For example, in mortgage lending, the lender will take into account the property being purchased and the homeowner’s equity. Many lenders look at their relationship with the customer, which may include other financial services. Each lender will have its own policies and you should feel comfortable asking a credit institution about these.